Dual Currency Bonds Are Most Appropriate for a Borrower Who

In finance an option is a contract which conveys to its owner the holder the right but not the obligation to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date depending on the style of the option. Includes local currency investment-grade fixed-rate sovereign bonds issued in 20-plus countries with remaining maturities of one year or more.

Agreement Between Two Parties For Money Template Google Docs Word Apple Pages Template Net Software Development Contract Template Money Template

Options are typically acquired by purchase as a form of compensation or as part of a complex financial transaction.

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

. Dollar and reflects the performance of the global sovereign fixed-income market. An unmanaged market capitalization-weighted index that is not hedged back to the US.

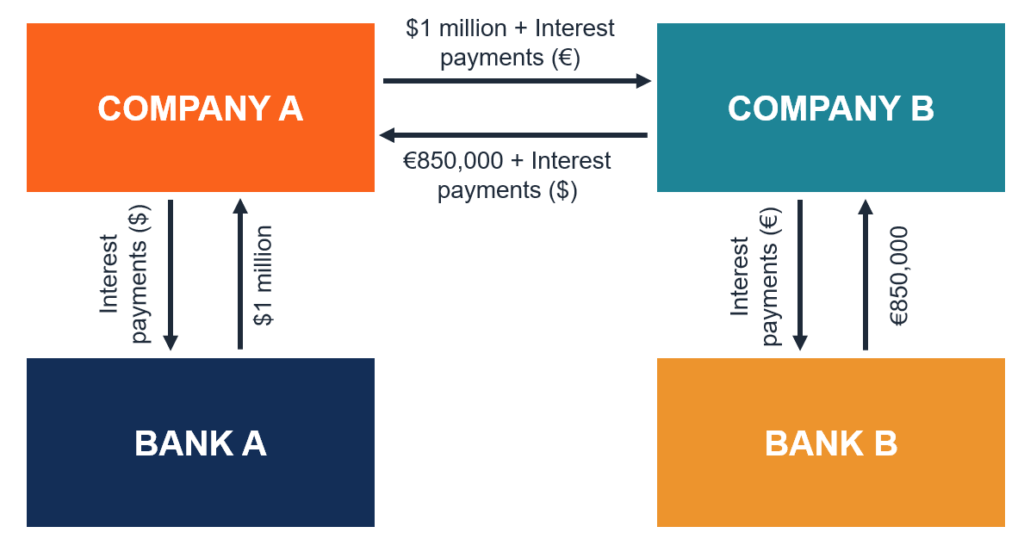

Currency Swap Contract Definition How It Works Types

Pin By The Project Artist On Understanding Entrepreneurship In 2022 The Borrowers Mortgage Loans Understanding

/dotdash_final_Currency_Carry_Trades_101_Dec_2020-01-159e176451ab46fe9eb2917525127277.jpg)

No comments for "Dual Currency Bonds Are Most Appropriate for a Borrower Who"

Post a Comment